Key Revelations in Jassy’s Shareholder Update and their Impact on Sellers

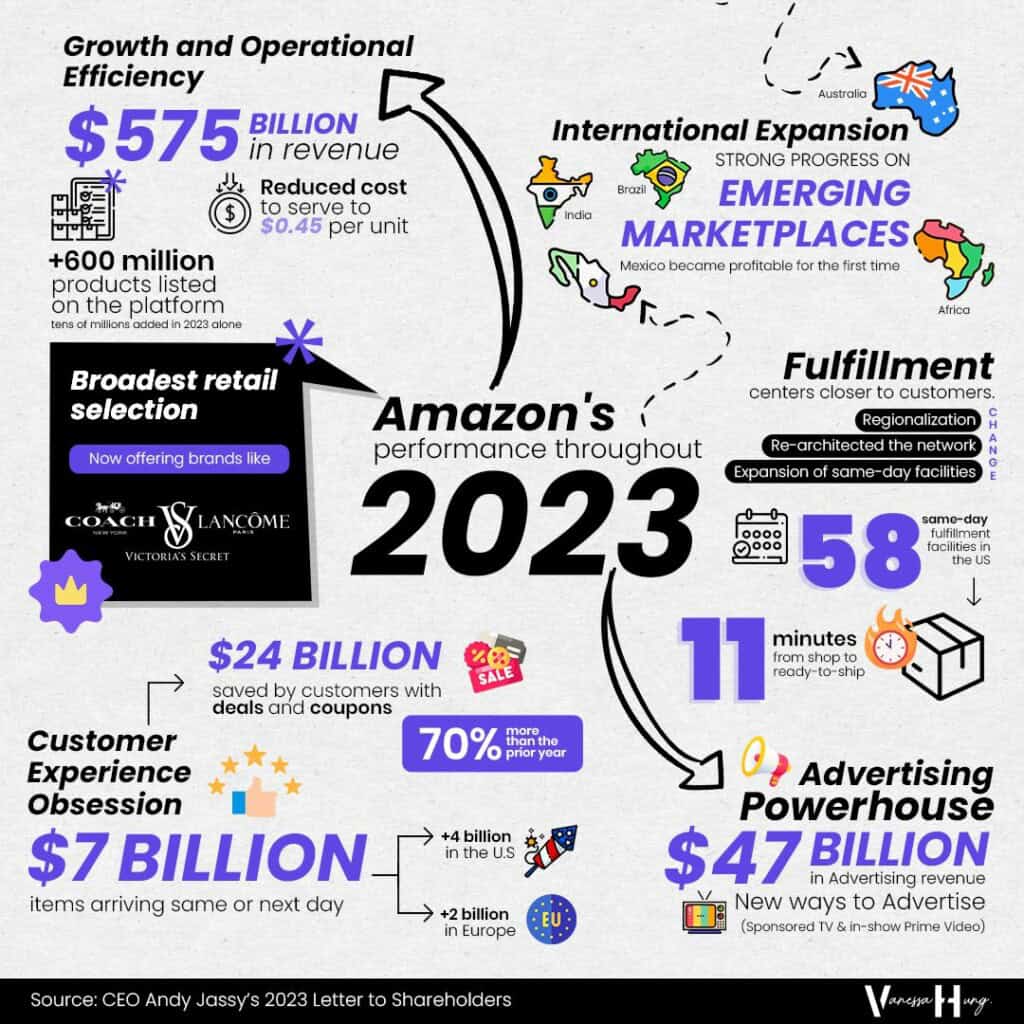

In his annual letter to Amazon shareholders released April 11, CEO Andy Jassy expressed even greater enthusiasm for Amazon’s future, citing a remarkable 12% increase in revenue for 2023.

The letter also covered “continued customer experience improvements across our businesses,” including the transformative potential of Generative AI and the advantages of Amazon’s regionalized warehouse network.

Jassy also highlighted the company’s ongoing efforts to cut costs, underscoring its commitment to efficiency and growth. Although Amazon has yet to announce a date for its first-quarter earnings report, shareholders can anticipate updates during the annual shareholder event scheduled for May 22.

However, despite Jassy’s optimism, some longtime sellers were left feeling disillusioned after his recent CNBC interview, which coincided with his shareholder letter announcement. While Jassy praised the benefits that Amazon provides to sellers, his comments clashed with the frustration felt by sellers over new fees imposed by the tech giant.

Pivoting to AI

Jassy is enthusiastic about artificial intelligence, particularly Generative AI, which he believes is the next frontier.

“Generative AI may be the largest technology transformation since the cloud – which itself, is still in the early stages – and perhaps since the internet,” Jassy wrote.

In his letter, he emphasized that Amazon’s AI initiative will involve a three-tiered approach:

- The foundational layer is geared towards developers and tech companies constructing or training their own AI models.

- The middle layer allows customization of existing models with user data, facilitated by Amazon’s Bedrock service. This layer is suited for a wider range of industries looking to build and scale custom generative AI apps.

- Finally, the top layer comprises various AI applications integrated across Amazon’s consumer businesses, such as Rufus, an AI shopping assistant, and enhanced Alexa features, alongside expanded advertising capabilities.

While these AI efforts may seem beneficial to customers and sellers, concerns arise about AI’s impact on major tech platforms. In a podcast interview, New York Times columnist Ezra Klein lamented the decline of internet quality due to AI-generated content flooding search results and social media feeds with misinformation and spam.

This flood of AI-generated content exacerbates existing issues like fake reviews on platforms like Amazon.com. Despite these concerns, he feels that companies like Amazon haven’t taken proactive steps to address the problem, leaving customers wary of the quality of their online experiences, which we’ve discussed in this article.

In fact, the term “generative AI” is mentioned multiple times, with Jassy expressing satisfaction in maintaining the broadest retail selection, potentially making it harder to combat fraud on the platform.

Jassy elaborated on Amazon’s pivot to AI during an interview on CNBC’s Squawk Box, highlighting its transformative potential in enhancing customer experiences.

Faster Delivery Speeds

As the retailer transitioned to a regional model, outbound shipping expenses saw a significant decrease. Amazon strategically stocked thousands of highly demanded products in warehouses across various US regions, facilitating same-day and overnight deliveries.

In 2023, over 7 billion products were delivered within this timeframe, with more than 4 billion in the US and 2+ billion in the EU, indicating that speedy logistics and fulfillment are essential for the ecommerce success of sellers. To enhance efficiency further, Amazon plans to double the number of same-day warehouses, aiming to pick, pack, and ship many items in as little as 11 minutes.

These same-day facilities are expected to benefit Amazon’s grocery and pharmacy divisions, with plans to offer rapid delivery of perishable and non-perishable foods, as well as commonly ordered medications within an hour, supported by the expansion of the drone delivery business.

Continued Cost-Cutting Efforts

Jassy noted a significant decrease in the company’s “cost to serve” on a per-unit basis globally, marking the first decline since 2018, with US figures showing a decrease of over 45 cents per unit compared to the previous year. These reductions are attributed in part to Amazon’s regionalization efforts, which have effectively minimized transportation distances and associated costs.

The company also witnessed a 201% year-over-year improvement in operating income for 2023. As it sets its sights on 2024, Jassy reaffirms Amazon’s dedication to further cost reduction endeavors. This includes a continued focus on optimizing fulfillment architecture and enhancing inventory placement strategies to drive efficiencies across its operations.

Amazon is reportedly doubling down on integrating robotics into its operations, with more than 750,000 robots now working alongside its workforce.

Despite being the world’s second-largest private employer, with 1.5 million employees, there has been a reduction of over 100,000 workers since 2021. This shift is notable considering that retail giant had 520,000 robots in 2022 and only 200,000 in 2019. While it is adding hundreds of thousands of robots annually, it is concurrently reducing its human workforce.

Warehouse robots are engineered to automate repetitive tasks, enhancing efficiency, safety, and delivery speeds for customers. This may sound great for sellers and customers, but this raises questions regarding the future role of human labor within the Amazon’s operational framework. The potential effect on employment, especially in roles characterized by high repetition and susceptibility to automation, is a subject of widespread concern.

Related: Amazon Warehouse Automation Increases Concerns over Job Loss and Product Selection Inaccuracy, Amazon Tweaks Logistics Strategy to Streamline Operations, Amazon Announces Further Cuts Amid Economic Uncertainty

Amazon’s Advertising Arm Booms

Amazon Ad Business has emerged as a key revenue driver, surging from $38 billion in 2022 to $47 billion in 2023, marking a notable 24% increase, which is twice the growth rate of the company’s overall revenue. This highlights the sellers’ need to heavily invest in Sponsored Ads to ensure their products gain visibility.

Failure to do so risks losing market share to competitors who are actively engaging in Amazon ad campaigns. The prevalence of advertising on marketplaces, including platforms outside of Amazon, indicates a fundamental shift in the ecommerce industry. As advertising becomes increasingly ubiquitous, sellers must factor in additional costs when calculating margins to remain competitive on Amazon and beyond.

Related: 3 Ways to Level Up Your Amazon Advertising Strategy, How To Optimize Amazon Attribution – the Secret to Off-Amazon Marketing, How to Use Amazon PPC to Scale Your Amazon Business

Backlash Against Amazon CEO: Sellers Criticize New Fees

When questioned by interviewer Andrew Ross Sorkin about the Federal Trade Commission’s antitrust lawsuit concerning Amazon, which alleges that the retailer exploits its influence over its selling partners, Jassy stood by the company’s treatment of SMEs, asserting its fairness and supportiveness.

However, Jassy’s claim of a great relationship with sellers has sparked criticism from those who feel their connections with Amazon are at an all-time low.

“It’s not hard to actually create software to put up an e-commerce website or storefront. It’s much harder to get distribution and access to customers, which is what Amazon gives sellers,” Jassy said.

“Sellers are making a lot more money selling on Amazon than they could on their own,” he added.

“If you look at things like FBA, which is our service that allows you to store your products with Amazon, we’ll pick, pack and ship it for you and it also is available for Prime shipping… It costs money, so we charge a fee for it, but it’s much more cost-effective for sellers. And while there’s always things we can be doing better for sellers and we work really hard at it, we have a great relationship with sellers.”

While the CEO asserts that sellers greatly benefit financially from Amazon, some disagree, citing increased margin pressure and complexity imposed by the company. Specifically, Amazon’s implementation of new fees on sellers, including inbound placement fees, fees for low inventory in warehouses, and fees for items with high return rates, adds to their discontent and challenges on the platform.

Sellers have taken to social media and forum site Sellers Ask Sellers to express opinions over Jassy’s comments, with many claiming that Amazon’s relationship with them is deteriorating. Here are some insights from longtime sellers’ views on Andy Jassy’s CNBC interview.

- Perception of Disparity: Many sellers believe Amazon’s relationship with them is beneficial primarily from Amazon’s perspective, as it allows the company to make profits while dictating terms and fees. They feel that their needs and perspectives are often overlooked.

- Sellers’ Adaptation: Some sellers acknowledge that selling on Amazon can be profitable, but only for those who can adapt to Amazon’s changing requirements and fees. Those who find the terms too stringent may struggle, while others navigate the system successfully.

- Tone-Deaf Remarks: Jassy’s claims about having a great relationship with sellers have been perceived as tone-deaf by some sellers. They feel his comments do not reflect the challenges and frustrations they face, suggesting either a lack of understanding of their experiences or a disingenuous platitude.

- Vulnerability and Dependence: Sellers feel a sense of vulnerability and dependence on Amazon, which can be a “horrible way to do business,” as stated by one commenter. They acknowledge Amazon’s advantages, but also express concerns about the company’s ability to control every aspect of the seller’s experience.

- Need for Diversification: Sellers recognize the importance of diversifying their business beyond Amazon to reduce dependency and cope with Amazon’s terms and fees.

Overall, these insights point to a complex and often strained relationship between Amazon and its sellers, with sellers seeking more understanding and fairness in their dealings with the ecommerce giant.

While Amazon may have made progress in its “financial results and customer experiences,” sellers may wonder whether Amazon’s gains will translate into their losses.

Need more information?

- Send Message: We typically reply within 2 hours during office hours.

- Schedule Demo: Dive deeper into the nuances of our software with Chelsea.

- Join Live Upcoming Webinar: New to Amazon inventory management? Learn three inventory techniques you can implement right away.

Start Your Free Audit

Start Your Free Audit