UPDATED: Amazon Taps into $100B Retail Media Market, Invests in New & Cutting-Edge Ad Platforms

Update 06/30/2023: Amazon just rolled out two new advertising features and revealed plans to add an ad-supported tier for Prime Video to boost its booming retail media business!

- Add videos to sellers’ listings. EU Announcement. If you’ve been an Amazon seller for three months or more, you now have the opportunity to enhance your product pages by incorporating video content, such as product demos, installation guides, and setup tutorials. The addition of videos can significantly amplify your sales and reduce returns. Visit Amazon’s video upload page to get started.

- 3D product pages with Hexa. Amazon has collaborated with Hexa, a Tel-Aviv based 3D visualization platform, to enhance its product pages with 3D images. Leveraging the power of AI, Hexa’s innovative tech transforms the conventional 2D product images provided by merchants into lifelike 3D models. These 3D images can be seamlessly integrated into websites, social media platforms, and augmented reality (AR) applications.

Notably, these models offer an interactive experience as users can effortlessly maneuver and explore the product from various angles using their cursor. Hexa further assists its users by offering comprehensive services such as storage, management, distribution, and analysis for the 3D models they create.

- Ad-supported tier to Prime video. According to Axios, Amazon is considering launching an ad-supported tier for its video service to boost revenue and attract more subscribers through less expensive subscription plans. The launch date, however, remains unclear.

The move comes as more ad dollars shift from traditional TV to streaming platforms. Video streaming rivals Netflix, Disney+, and HBO have recently introduced their own ad-supported tiers. In its favor, while some rivals have only recently established their ad products, Amazon already has an established advertising team and other ad-supported video products, such as Freevee. This should play a significant role in guiding and enhancing the tech giant’s efforts in this area.

Amazon’s ad business is growing rapidly, with Q1 2023 ad revenue reaching $9.5 billion, a significant surge compared to the previous year. The company is also expected to capture 40% of new search ad dollars in 2023, per Insider Intelligence. It is possible that these figures may skyrocket even further once the new features roll out more widely and ads were to be introduced on Prime Video.

Not too long ago, retail media, aka marketplace advertising, caught the attention of advertisers as a rising digital channel, yet only a few big retailers like Amazon, Walmart, and Target dared to explore its potential.

Back in 2012, Amazon’s ad revenue amounted to just $609 million, and during that period, retail media was merely synonymous with advertising on Amazon itself.

Retail media networks like Amazon leverage their first-party customer data to serve customers relevant ads across search, display, or product pages. These ads can come in many forms, such as exclusive offers, coupons, and sponsored ads that appear during a shopper’s active browsing session on Amazon or other ad channels like Google Search and Facebook.

Related: Amazon Attribution Update Makes for a more Effective Sales Tool

Fast forward to 2022, retail media has experienced a phenomenal surge, primarily driven by the eCommerce boom. Advertisers allocated more than $40 billion toward retail media initiatives, with Amazon capturing an impressive 37% share of the total investment. Meanwhile, retail rivals Walmart and Target collectively accounted for a 36% share.

In a statement to Marketing Dive, Todd Krizelman, MediaRadar CEO, chalked it up to Amazon having such a “tight grip on the digital space that they really sit in a category of their own.”

“Other players are growing quickly, but it will be difficult for legacy brick and mortar retailers to beat Amazon on its own terrain.”

Overall, these major players dominated the retail media landscape, commanding 73% of total ad investment in 2022. And over the next few years, the $40B market could potentially more than double.

Future is Bright for Retail Media

Touted as the “new frontier” of advertising, retail media is the world’s third-largest digital channel behind social ads (2nd) and paid search (1st).

Consulting firm McKinsey & Co estimates that the expansion of retail advertising networks in the US has the potential to surge up to $100 billion in ad spending by 2026. Moreover, these advertising investments prove to be immensely lucrative, yielding operating profit margins ranging from 50% to 70%.

Media investment company, WPP & GroupM, also predicts that retail media will increase by 60% by 2027.

Such projections highlight the tremendous growth and profitability that retail media is poised to achieve in the coming years, with Amazon leading the way.

Leaning on the $100B retail media sector may catapult Amazon into the second spot of the overall US digital ad market, just behind Meta.

Peaking at the Right Time

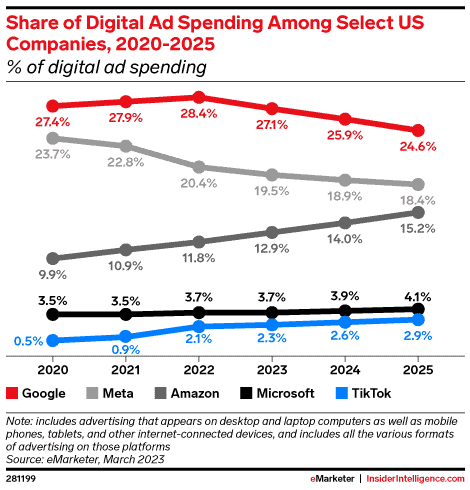

Insights from Insider Intelligence suggest that while Google and Facebook continue to see growth in their advertising businesses, their pace is comparatively slower than other areas of the US online ad market.

In the midst of this landscape, Amazon has been steadily gaining market share.

Per Insider Intelligence, Amazon accounted for 11.8% of US digital ad spending in 2022. This figure is projected to increase to 12.9% in 2023 and further to 14% in 2024.

By 2025, the total online ad market share gap between Amazon and Meta will be down to just 3.2% points. This goes to show that Amazon’s ad business has become one of its key strengths. And sellers are well-positioned to take advantage of this growth area with Amazon’s advertising tools.

Amazon’s Working to Expand its Ad Business to Accelerate Growth

With momentum on its side, the retail giant wasted no time in beefing up its advertising division. The company recently:

- Launched Amazon Anywhere, a groundbreaking program which allows customers to seamlessly browse and purchase tangible products from Amazon in virtual environments, such as video games, augmented reality (AR) experiences, and third-party mobile applications. With Amazon Anywhere, the boundaries between virtual and physical shopping blend, creating a truly immersive and convenient retail experience.

- Assembled a team to build an AI-powered tool that will generate images and videos for advertisers.

- Overhauled the Amazon Demand-Side Platform (DSP) to introduce more advanced machine learning and predictive algorithms to “enhance bidding and pacing decisions” and help advertisers reach “previously unaddressable audiences.” With these upgrades, users reportedly saw a 12.6% increase in click-through rate, 24.7% reduction in cost per impression, and 34.1% increase in return on ad spend.

- Hired Kelly MacLean, a seasoned monetization product engineer at Meta, as VP of Amazon’s DSP business. According to Business Insider, she will play an important role in demonstrating DSP’s new offerings to agencies and non-Amazon advertisers.

For sellers, these advancements could provide a new and better way to diversify their ad investments, optimize ads for performance, or reach untapped markets and thus, drive sales. For customers, improved search relevancy enhances the shopping experience by allowing sellers to offer them a more targeted product selection in real-time.

With this in mind, consider adopting a retail media strategy and seamlessly integrate it into your comprehensive marketing plans, if you haven’t done so already. This approach allows you to maximize the potential of Amazon’s available resources and leverage emerging opportunities in response to evolving customer behavior.

Related: Walmart Launches New Ways to Find and Buy Products, Amazon Will Pay Users $2/Month to Track Their Data, Amazon Now Allowing Email Marketing Campaigns to Repeat Customers, How to Optimize Amazon Attribution

Need more information?

- Send Message: We typically reply within 2 hours during office hours.

- Schedule Demo: Dive deeper into the nuances of our software with Chelsea.

- Join Live Upcoming Webinar: New to Amazon inventory management? Learn three inventory techniques you can implement right away.

Get Started

Get Started