Amazon’s Latest Moves: New Discount Page, AWD Enhancements, and Eco-Friendly Packaging

This week’s Amazon feature roundup brings a wealth of updates for sellers aiming to stay competitive and informed.

Amazon is poised to challenge popular discount giants Temu and Shein with a new discount section, promising to attract budget-conscious shoppers and potentially boost traffic to the platform.

The launch of new Shipment Tracking and Inventory Visibility APIs for Amazon Warehousing and Distribution (AWD) will offer enhanced logistical control, ensuring smoother operations and fewer surprises. Amazon is also expanding the range of products eligible for AWD to include shoes, providing footwear sellers with more flexibility and storage options.

The updated FBA Enrollment Opportunities tool is set to help sellers find lower FBA rates, optimizing costs and maximizing profitability.

As regulatory landscapes evolve, Amazon sellers must stay ahead with the upcoming EU Batteries Regulation requirements for Extended Producer Responsibility (EPR).

Lastly, Amazon’s significant reduction of plastic air pillows in North American packaging underscores the retailer’s commitment to sustainability—an initiative that could resonate with eco-conscious consumers and enhance brand image.

Dive into this article to explore these developments in detail and discover how they can impact and benefit your Amazon business.

1. Amazon Challenges Temu and Shein

Amazon is planning to launch a new discount storefront aimed at competing with popular low-cost eCommerce platforms, Temu and Shein. This new section will feature unbranded apparel and household goods, primarily priced under $20, shipped directly from warehouses in China.

By doing so, Amazon aims to offer products at significantly reduced prices, appealing to bargain shoppers.

How the New Discount Page Works

The discount storefront will feature a variety of unbranded items, such as facial massaging tools, arm weights, and phone cases, all shipped from China to the US within nine to eleven days.

Unlike the traditional FBA model, this new approach allows Chinese sellers to ship products directly to customers, potentially reducing overhead costs. This method also enables sellers to test new items through small-batch production, similar to Shein’s on-demand manufacturing model.

Related: How Temu Might Compete with Amazon in the US Market

Impact on Competing Sellers in the US

Amazon’s plan to introduce a discount storefront featuring Chinese goods at bargain prices is causing significant concern among American sellers, who fear it will further erode their market share and profit margins, according to Modern Retail.

Meanwhile, on Sellers Ask Sellers, many sellers have expressed their apprehensions and frustrations, highlighting the potential negative impacts of this move.

Erosion of Market Share

The introduction of a dedicated discount section on Amazon’s platform is expected to attract price-sensitive customers who are currently gravitating towards Temu and Shein.

In an interview with Modern Retail, Lori Barzvi, who sells washable pee pads for dogs under the Pupiboo brand, noted that “Amazon customers are already price-sensitive, and a dedicated discount section could further erode our market share.”

This sentiment is echoed by other sellers who worry that the established trust and reliability of Amazon will eliminate the hesitation some consumers have about purchasing from lesser-known platforms, accelerating the shift towards ultra-cheap purchases from China.

Increased Competitive Pressure

The new storefront will likely intensify competitive pressure on American sellers. Barzvi highlighted the compounding issue of new fees introduced by Amazon earlier this year, which have already pressured sellers’ profit margins.

“The combination of these fee increases and the pressure to lower prices to compete with the new discount platform could make it unsustainable for many small businesses to continue operating on Amazon,” she said.

This comment is shared by other sellers who feel that the fee increases, coupled with the need to compete with bargain prices, may drive many small businesses out of the market.

Concerns About Quality and Product Safety

Sellers also express concerns about the quality and safety of products that will be featured in the new discount section.

One seller from the Sellers Ask Sellers forum commented, “I mean, it’s not FBA so I guess if people wanna wait for cheaper stuff which is most likely not vetted for quality they can.”

There is a fear that highlighting low-cost, potentially low-quality products will undermine the overall quality perception of Amazon’s offerings. Additionally, there are worries about the lack of stringent quality control, with sellers questioning who will take responsibility if something goes wrong with these products.

Related: Amazon Expands A-to-Z Guarantee and Introduces New Tools for Sellers

Potential for Increased Counterfeits and Liability

Another significant concern is the potential increase in counterfeit goods and associated liability. Judah Bergman, CEO of Jool Baby, mentioned his concern about incentivizing “bad apples” by making it easier for Chinese sellers to ship products directly from overseas. Given Amazon’s ongoing struggles with counterfeit products, this move could exacerbate the problem, undermining trust in the platform and posing risks to consumers.

Strategic Shifts and Adaptations

Some sellers view the potential changes as a reason to adapt their strategies. Comments from the Sellers Ask Sellers forum suggest that sellers might need to focus on niche products that are harder to replicate or move away from high-volume, low-margin items.One seller suggested that “building the brand is a real thing,” indicating that a strong brand presence and high-quality products might be necessary to withstand the increased competition from low-cost imports.

Related: How to Craft an Ecommerce Brand That Roars, 5 Top Strategies for a Winning Amazon Product Launch, Emotional Appeal: The Secret Strategy of Ecommerce Seller Success

Impact on the Environment

The environmental impact of the new discount storefront could also be significant. The focus on importing inexpensive goods from China raises concerns about the carbon footprint associated with long-distance shipping.

Additionally, the potential for increased waste from cheap, disposable products could contribute to environmental degradation. This model of fast and affordable retail has been criticized for its unsustainable practices, including the extensive use of plastics and the rapid turnover of low-quality goods.

Final Thoughts

Amazon’s new discount storefront represents a strategic move to compete with rising eCommerce platforms like Temu and Shein. While this initiative may benefit consumers through lower prices and increased product variety, it poses significant challenges for US sellers, and the environment.

To stay competitive, American sellers might need to adapt their strategies, focusing on niche markets and building strong brand identities.

Overall, the long-term implications of this move will depend on how effectively Amazon can balance these competing interests while maintaining its market dominance.

2. Amazon Expands AWD Capabilities with New APIs and Eligible Products

Amazon has announced significant updates to its Amazon Warehousing and Distribution (AWD) service, aimed at improving efficiency and expanding opportunities for sellers. The eCommerce giant has launched new Shipment Tracking and Inventory Visibility APIs and expanded the range of products eligible for AWD to include shoes.

Launch of Shipment Tracking and Inventory Visibility APIs

In a bid to enhance inventory management and streamline operations for sellers, Amazon has introduced the first set of Selling Partner (SP) APIs for AWD. These include the AWD Shipment Tracking API and the AWD Inventory API.

How It Works

- AWD Shipment Tracking API: This API provides tracking and status updates for inbound shipments. Sellers can now monitor the progress of their shipments to AWD facilities.

- AWD Inventory API: This API offers visibility into inventory levels and states within Amazon’s storage network. Sellers can see current stock levels, identify which items are in storage, and get updates on inventory movements.

Sellers can access these APIs through the SP-API portal by making a developer profile for direct integration or through third-party providers utilizing the APIs.

Benefits for Sellers

- Automated Inventory Management: The APIs help automate inventory planning, integrating seamlessly with existing supply chain management tools.

- Enhanced Visibility: Updates on shipment status and inventory levels allow sellers to make informed decisions and respond swiftly to changes.

- Improved Efficiency: By automating many aspects of inventory management, sellers can reduce manual tasks and focus more on strategic business activities.

Amazon has also announced plans to enhance these APIs further by adding SKU-level granularity for inbound shipment reconciliation and in-transit quantities for end-to-end visibility. Updates will be shared through the Seller Central Forums as they become available.

Expansion of Product Eligibility: Shoes Now Eligible for AWD

In another update, Amazon has expanded the range of products eligible for AWD to include shoes. This move opens up new opportunities for sellers in the footwear category to leverage Amazon’s Warehousing and Distribution services.

How It Works

- Product Eligibility: Footwear, products with no expiration date and not considered dangerous goods are now eligible for AWD.

- Carton Specifications: Conveyable boxes must be smaller than 25 inches on any side and weigh 50 pounds or less.

- Large Standard-Size ASINs: Individual products should be 18 inches long, 14 inches wide, 8 inches high or smaller, and weigh 20 pounds or less.

- SKU Packing: Only one unique SKU per box or carton, so avoid combining different SKUs per box/carton.

- Shipment SKU Limit: Up to 150 unique SKUs for each shipment.

Benefits for Sellers

- Scalability: As sellers grow their business, they can easily scale their operations using Amazon’s extensive warehousing and distribution network. This scalability is particularly beneficial for seasonal spikes in demand, such as during holiday seasons or promotional events.

- Streamlined Logistics: By using AWD, sellers can simplify their logistics processes, ensuring that their products are stored and managed efficiently.

- Save on Certain FBA Fees: With auto-replenishment, AWD takes charge of replenishing sellers’ inventory into FBA for them. As a result, concerns about low inventory levels, storage utilization, and capacity overage fees do not impact sellers at the SKU level when they auto-replenish 70% or more of that SKU to FBA via AWD within the past 90 days.

- Added Benefits of the AWD Integrated Rate: According to Amazon, if using Amazon Global Logistics (AGL) or Partnered Carrier Program as transport service provider for your AWD shipments, you can save $0.12 per cubic foot per month on storage fees. For instance, storing 1,000 cubic feet of inventory would cost $480 per month at the base rate ($0.48/cu ft/month if using your own third-party shipping provider), while the integrated rate (e.g., AWD and AGL) would bring this down to $360 per month, saving $120.

Related: Save on Storage: AWD’s Special Second Month Promotion, Optimize Your Profit with Proven Strategies

3. Amazon Upgrades FBA Tool to Help Sellers with Product Choices and Cost Analysis

Amazon has updated its FBA Enrollment Opportunities tool to help sellers:

Identify Which Merchant-Fulfilled Products To Enroll In FBA

- The tool offers benefits for Merchant-Fulfilled Network (MFN) sellers by providing catalog recommendations for products that could gain from being enrolled in FBA. It helps also sellers identify a prioritized list of ASINs, highlighting those with potential sales uplift and FBA-related discounts, making it easier to decide which products to transition to FBA for optimal performance and cost efficiency.

Identify Low-Priced Product Opportunities

- The tool can identify MFN products priced below $10 that qualify for Low-price FBA fees.

- Sellers can compare these low-price FBA fees with the standard FBA fulfillment fees to make more cost-effective decisions.

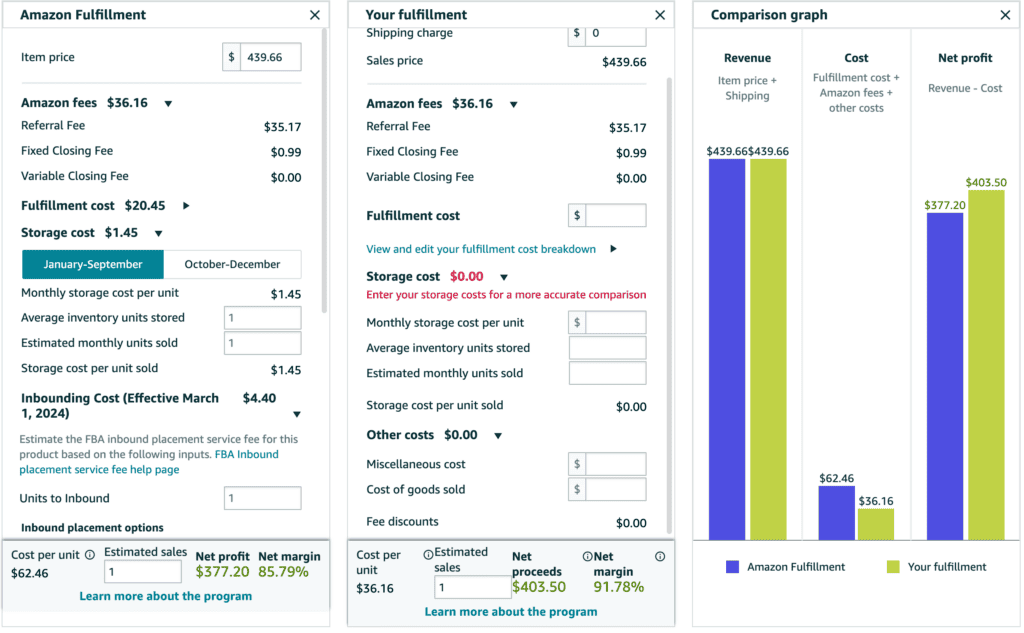

Calculate Fulfillment Costs with an Integrated FBA Revenue Calculator

- Net Margin and Proceeds: Calculate net margin, net proceeds, and total costs (both Amazon and non-Amazon costs) for each product.

- Cost Comparison: Compare your own off-Amazon fulfillment costs with FBA costs to identify potential savings.

- Inbound Placement Costs: Calculate costs for inbound placement options based on the region to plan logistics more efficiently.

- Additional FBA Services: Include costs for additional services like labeling and packaging to get a complete picture of expenses.

- Factor Peak and Off-Peak Season Fulfillment Costs: Calculate holiday season (October-December) and off-peak (January-September) fulfillment costs for better long-term planning.

Seller Reactions and Insights

The seller community has provided mixed reactions to this update. Here are some of their insights:

Cost Control Concerns

One seller emphasized the advantages of MFN, or Fulfillment By Merchant (FBM), over other methods on Amazon, stating that it remains the most cost-effective. They noted that with a single known commission on each sale, sellers have better control over their profits compared to other models. According to the seller, FBM eliminates monthly fees that can erode profitability, highlighting its appeal for maintaining financial control in Amazon sales strategies.

New Seller Challenges

Another seller commented, “I’m considering FBM so I can start making a profit. FBA is very convenient and helpful but as a new seller who is struggling to find suitable products to sell it’s becoming daunting.”

Despite these concerns, the enhanced tool is designed to provide greater transparency and support for sellers, particularly new ones, to navigate these challenges more effectively.

The updated FBA Enrollment Opportunities tool offers several benefits:

- Informed Decision-Making: Sellers can make more informed decisions about product enrollment by having a clearer understanding of fulfillment costs and potential profits. And with detailed cost comparisons and insights into additional FBA services, sellers can identify ways to improve their profit margins.

- Cost Efficiency: By identifying low-price products eligible for special reduced fees, sellers can optimize their pricing strategy and reduce overall fulfillment costs.

- Comprehensive Planning: The integrated Revenue Calculator provides a complete breakdown of costs, enabling sellers to plan better and forecast expenses, especially during peak seasons.

In sum, the updated FBA Enrollment Opportunities tool represents a step towards empowering sellers with the information they need to succeed on the platform. While some sellers may still prefer FBM for cost control, the new tool offers a compelling value proposition for those looking to leverage FBA’s convenience and reach.

4. Amazon Announces Upcoming EU Batteries Regulation Requirements for Extended Producer Responsibility (EPR)

Amazon has announced the upcoming requirements for the EU Batteries Regulation related to Extended Producer Responsibility (EPR), which will take effect on August 18, 2025. From this deadline onward, Amazon will be obligated by law to take action, either deactivating non-compliant listings or ensuring compliance on behalf of sellers, contingent upon the regulations in each respective country.

This regulation mandates that all eligible standalone batteries and batteries contained within products sold in the EU must adhere to specific compliance measures, including carrying a Conformité Européenne (European Conformity) mark and having an EU Responsible Person.

Steps to Compliance

Step 1: Registration

Identify as a Producer: In the context of battery regulation in Europe, the term “producer” refers to “any manufacturer, importer or distributor who, irrespective of the selling technique used, including by means of distance contracts (an agreement between a seller (or service provider) and a consumer conducted via methods like phone, internet, mail order, or fax), supplies a battery for the first time for distribution or use, including when incorporated into appliances or vehicles, within the territory of a Member State on a professional basis.”

In many EPR schemes across Europe:

- Manufacturers: These are typically considered the primary producers. They are responsible for ensuring compliance with EPR requirements, which may include recycling, collection, and disposal of products at the end of their life.

- Importers: If the product is imported into the EU, the importer may take on the responsibilities of the producer under EPR regulations.

- Retailers/Sellers: In some cases, especially for products sold under private labels or imported by retailers, they may also be considered producers under EPR laws. This depends on whether they meet the definition of a producer by placing the product on the market for the first time.

Read Amazon’s definition of battery producer for more information.

established in an EU member state and resells batteries within the territory of that member state

If you are considered a producer located within the territory of an EU member state, e.g., Germany, you need to register in that said country.

Alternatively, if you operate as a producer outside the country where your products are sold, designate an authorized representative, AKA Producer Responsibility Organisation (PRO), located within that country. This representative serves as your legal proxy to fulfill all producer obligations required by law.

Available Registrations: You can currently register in the following EU member states:

- France: SYDEREP

- Germany: Stiftung ear

- Italy: Registro Pile e Accumulatori

- Poland: BDO

- Spain: Sede electrónica RII_PYA

- Sweden: Naturvårdsverket

Future Notifications: Amazon will notify sellers when registration opens in other EU member states.

For Resellers: If you use drop-shipping or resell batteries, obtain registration numbers from your upstream suppliers.

Step 2: Proving Compliance

Submit your registration numbers on the upcoming Compliance Portal for each registered EU member state. This portal is expected to go live in Q3–Q4 2024.

Step 3: Annual Reporting and Eco-Fees

Annually report your battery sales and pay the corresponding eco-fees to the relevant EU authorities or PROs. Eco-fees refer to fees that are charged to consumers or producers to finance the costs associated with the collection, treatment, recycling, and disposal of batteries in an environmentally friendly manner.

Ongoing Updates and Support

Amazon will provide updates on country-specific EU batteries requirements for EPR as they are confirmed by the EU member states. Details on how to submit registration numbers and pay eco-fees will also be shared by Q3–Q4 2024.

Additional Information

For more details, visit the EPR requirements: EU batteries page on Amazon Seller Central.By adhering to these new regulations, sellers can ensure their continued compliance and avoid any disruptions to their business operations within the EU market.

Related: A Comprehensive Guide to Global Ecommerce for US Sellers

5. Amazon Implements Major Reduction of Plastic Air Pillows in North America

Amazon has taken a major step towards sustainability by eliminating single-use plastic air pillows from 95 percent of its delivery boxes across North America. This move, announced on June 20, 2024, is part of Amazon’s broader initiative to cut down on plastic waste and transition to more eco-friendly packaging solutions ahead of the 2024 holiday retail season.

The decision to phase out plastic air pillows is expected to eliminate approximately 15 billion of these cushions annually, marking Amazon’s largest plastic reduction effort to date. This follows a similar initiative in Europe in 2022 and reflects Amazon’s commitment to sustainability across its global delivery network.

Related: Amazon Introduces AI-Driven Packaging to Reduce Waste, Amazon and EIT Climate-KIC Offer Financial Boost to Sustainable Startups

How this Move Might Change Your Packaging Practices

For Amazon sellers, this transition means reevaluating how they package their products for shipment. Historically, many sellers have relied on plastic air pillows for added cushioning to protect items during transit.

With Amazon’s shift to recycled paper and other sustainable materials, sellers will need to adapt their packaging strategies to align with these new guidelines.

Key Insights and Considerations

- Environmental Impact: By eliminating plastic air pillows, Amazon aims to reduce its environmental footprint significantly. The switch to paper-based alternatives, which are more readily recyclable and biodegradable, aligns with growing consumer and regulatory expectations for sustainable packaging practices.

- Challenges of Plastic Recycling: Plastic air pillows pose recycling challenges due to sorting and processing issues. In contrast, paper-based materials are easier to recycle and often have existing recycling infrastructure support.

- Technological and Process Changes: Amazon has invested in innovation and testing to ensure the efficiency and effectiveness of its new packaging solutions. This includes redesigning packaging equipment and processes to accommodate the switch from plastic to paper-based materials.

Operational Implications: The adoption of paper-based packaging not only supports environmental goals but also enhances package handling efficiency. Depending on the quality and thickness of the material used, paper may absorb shocks better than plastic pillows, potentially providing improved protection for shipped items.

Related: How Amazon Businesses Can Leverage Sustainability Initiatives to Drive Brand Growth and Reputation

Future Outlook

Looking ahead, Amazon plans to continue phasing out single-use plastics globally, aiming for a more sustainable and efficient delivery network. This initiative highlights the importance of rethinking packaging practices in eCommerce to meet evolving environmental standards and consumer preferences.

As Amazon sets a precedent with its packaging sustainability efforts, sellers are encouraged to explore alternative packaging materials and methods that align with these goals. Adapting to these changes not only supports green initiatives but also enhances customer satisfaction and brand reputation in an increasingly eco-conscious market.

Related: Right-Size Products To Save on FBA Fees, Master Carton Calculator to Optimize Packaging & Reduce Shipping Costs

Need more information?

- Send Message: We typically reply within 2 hours during office hours.

- Schedule Demo: Dive deeper into the nuances of our software with Chelsea.

- Join Live Upcoming Webinar: New to Amazon inventory management? Learn three inventory techniques you can implement right away.

Start Your Free Audit

Start Your Free Audit