Amazon Seller Insurance Tips

Do you remember the Suez Canal fiasco, where a cargo ship with over 18,000 containers got stuck sideways in the canal? As you can imagine, there was a significant delay of all of the cargo on that ship and the 300+ ships waiting to cross the canal, creating chaos at the ports.

Is there a way to mitigate some of the damages of an incident like this with inventory management? We’re not just talking about a week of delays; we’re talking weeks of delays. We not only have to consider the week’s worth of time that the ship was held up, but also the backup in the ports of all of the ships bottlenecked in that area. The global economists say that the estimated damages and loss for this particular incident were valued as much as $400,000,000/hour, which is UNBELIEVABLE!

In light of this incident, Amazon seller insurance questions have become more critical and relevant to discuss than ever before. The insurance topic is a classic necessity for business owners, and there’s a lot to learn. As an Amazon seller, there are specific types of insurance that you are required to have; but which ones are right for YOU, and which are a waste of money? The best person to educate you is your insurance agent, but we can start today by covering the following:

- Who needs Amazon seller insurance?

- Why do sellers need insurance?

- What insurance does Amazon require?

- What’s the best insurance for Amazon sellers?

- What are the different types of Amazon seller insurance?

- Which business insurance is essential for YOU to have?

The right kinds of insurance offer ways to mitigate many problems Amazon sellers might face. Let’s start with cargo insurance.

In this Amazon Seller Insurance Tips guide, we’ll take a look at:

Cargo Insurance

Cargo insurance helps to safeguard against loss and damage during the shipping process, for example, if your product gets lost, damaged, or stuck at the port. Particularly if you’re sending goods from overseas, like many of us sellers are, it’s essential to be aware of what it is and your potential need for it.

Let’s say you have extended lead times of 90 days, 120 days, or even longer. What’s the impact going to be if your entire shipment gets lost and you have a 120 day lead time? You’ll try to find your shipment, maybe hold off for a while, hoping it will be found or recovered, but it just doesn’t happen. And now, because you have to start the whole process over again, you stock out. How long is that stockout going to last? How much damage will that do to your business?

If you are worried about this particular type of risk, cargo insurance will help to cover these potential damages and losses; if not entirely, at least partially. I would recommend you look into it for your business. It’s vital to talk to a professional insurance agent who understands eCommerce and Amazon or works with people in your industry. I’ll talk about someone you can contact (if you’re interested) in the last section of this article.

You must understand exactly what your insurance covers. You don’t want to find out what it covers after submitting your claim, only to have it rejected. That’s not the way that you want to understand your business or your insurance.

Make sure that all of your products are covered by asking these questions:

- Under what circumstances are my products covered?

- Are my products covered for loss damage?

- Are my products covered for delays?

- How much coverage do I have for each event?

- What’s my total coverage?

- Am I covered for lost revenue? Lost sales ranking? How could that type of loss be factored into the damages?

The actual cost of goods value of the inventory is probably the most common coverage rather than the retail cost. But you can also find out if you’re covered for lost revenue or lost sales ranking up. These things probably won’t be covered, but you can determine if there are contingencies to get that type coverage.

It’s almost guaranteed you’ll have to pay more for more extensive coverage, but again, something to ask your agent. Read the fine print and make sure that you understand it. A good agent can help you understand all aspects.

General Liability Insurance

General liability insurance covers you against potential lawsuits and is another insurance that you want to have. In fact, as an Amazon seller, you need to have it. Amazon has specific requirements laid out in their policies which I’ll cover later.

General liability insurance covers you for typical liabilities such as falls, false advertising, medical expenses, and legal fees for most general bodily injury or property damage issues that may arise in running your business.

Surprisingly, this will most likely not cover any accidents that are surrounding your product. If you have a product with blades, for example, and someone cuts themselves and tries to sue you, unfortunately, general liability will probably not cover that incident. You’ll need something to add to your general liability insurance–product liability.

Product Liability Insurance

Another critical one for Amazon sellers, product liability insurance addresses injury, property damage, legal fees, anything surrounding damaged or defective products. It’s not necessarily something that Amazon requires, but you should consider having, especially if you have a product that does pose more risk. You can add product liability insurance to your general liability insurance.

A blanket might not pose a significant risk, but if you’ve got something with blades, lighters, glass, electronics, or any kind of fire element, you might want to consider it. We’re in the kitchen category, and some of our products have blades. We’ve had upset customers write in about cutting themselves, which was enough to have me seek out product liability insurance. If your products open you up to risk in this way, it’s better to have the insurance than to put your entire business, livelihood, and even your assets at risk.

Again, find out if all your products are covered and to what extent because not every product is necessarily going to be protected. Some might be excluded from the product liability insurance.

Amazon Suspension Insurance

Amazon suspension insurance is a newer coverage that you may want in case your account gets suspended. It can also be bundled with your general liability insurance. For this type of insurance, you want to talk to an Amazon insurance specialist. Again, you want to find out EXACTLY how much coverage you have by asking these questions:

- Is there a limit to the amount of coverage I have?

- How is the value of the loss determined? By loss of revenue or loss of ranking?

- What exactly is covered?

- Are legal expenses covered if I have to get legal help to get reinstated?

- Are there reinstatement fees or a consultant to help me get reinstated?

- Are consulting fees for the reinstatement covered?

Now let’s talk about who needs insurance.

Amazon Seller Insurance Requirements

Pretty much everyone needs some form of insurance. Assess your risk and decide what is best for you with your insurance agent. You don’t want to have so much insurance that you can barely pay your bills, but you do want to have enough insurance to cover the potential emergencies that might come up. And again, Amazon does require you to have some insurance once you get past a certain low revenue threshold. See below for details.

To sell on the platform, you need a specific type of insurance. We’ll take a look at what Amazon requires.

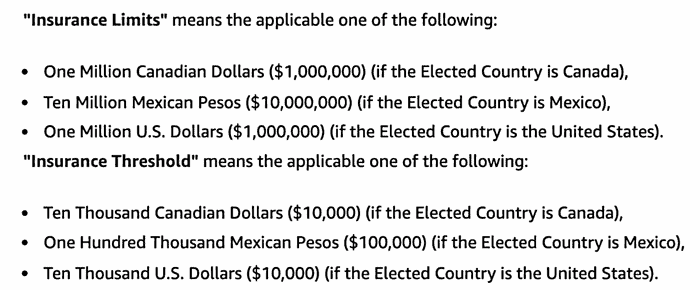

First, I want to talk about the limits and thresholds that are specifically for the North America region as there’s an insurance threshold and limit which we will define and clarify. Insurance limits are the lowest amount of insurance that you should have if selling on Amazon. If you’re selling in the United States and your elected country is the United States, the lowest amount of insurance coverage you need is $1,000,000 USD.

The insurance threshold is the revenue amount of sales that you are making in that particular area that makes you eligible for being required to have this insurance. The insurance threshold in the US is $10,000.

Let’s get a little bit more specific on this. What exactly does this mean? Here’s what Amazon’s policy says about the insurance threshold: “you are required to obtain and maintain commercial liability insurance within 30 days after exceeding $10,000 in gross proceeds from your sales for three consecutive months, or if otherwise requested by us.”

So if you’re making more than $10,000 in sales every month, you need to have general liability insurance. It’s smart business, but Amazon also requires it.

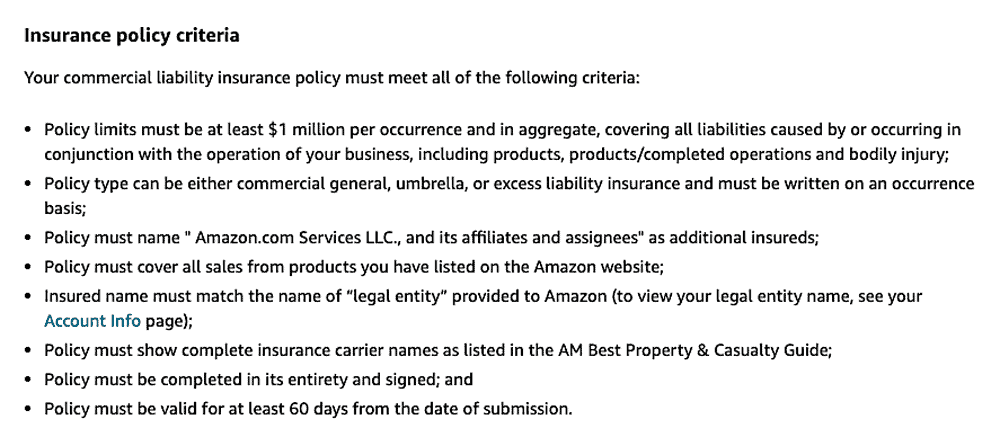

The last point addresses the policy requirements. This is the insurance criteria, what is needed for your liability insurance. You need to have at least $1,000,000 per occurrence and, in aggregate, covering all liabilities. Per occurrence means that if someone sues you, the insurance company will cover up to a million dollars for that suit. If someone else sues you for a separate incident, they’ll cover a million dollars for that suit also. However, in aggregate means that you will only have $1,000,000 in total liability coverage for all occurrences within a certain time period, usually a full year.

An umbrella policy or an excess liability policy might have different terms and stipulations. By bundling your general liability and excess liability with the same company, you might be able to lower your total monthly premium. Many people use excess liability to increase the coverage limits beyond the million dollars while keeping cost lower than if they were to simply increase their limits on the general liability. One common type of excess liability that not only raises your limits but also broadens your coverage is called umbrella insurance because it can cover those things your general liability insurance covers, but it can also cover things like home, auto, and warehouse. If you’ve got a larger business and you’ve got many other things that you want to cover, this will also be relevant for you.

Another thing to note about this policy is that you have to name “Amazon.com Services LLC and its affiliates and assignees” as additional insured, if you are selling in the United States. This means that you are extending your coverage to include covering Amazon.com for liability as well, meaning that Amazon.com can file a claim if needed should they get suited due to your business activities on the platform. You will have to check on Amazon Seller Central for the additional insured for the other marketplaces.

You must include this wording on an insurance certificate naming Amazon as an additional insured and provide that to Amazon. I’m surprised that Amazon doesn’t ask about this. Even though they require it in their policy, they don’t actually seem to follow up or request it.

Your insured name must match your legal entity on Amazon. If it doesn’t, then you get into some technicalities, and then all of a sudden, you’re not going to be covered. And that is a big problem. So you could be paying on insurance, but if your legal entity does not match your insured name, then you’re not technically covered. To understand more about Amazon’s policy requirements, this link will take you to the full Amazon insurance requirements for your reference.

Much of this is in place because Amazon needs to protect itself if your product harms someone and that person files suit, because potentially they could name Amazon in that suit.

Amazon wants to have your insurance cover an incident like that because they don’t want to assume liability for your product just because you’re selling it on their marketplace. So it protects Amazon, but it also protects you. If Amazon got sued by a single person or a couple of people, I’m sure they could weather that storm, but I’m not sure that you could. So it protects you more than it protects Amazon ultimately. But Amazon also has a much more considerable risk because they’ve got millions on their platform.

The Bottom Line

The bottom line is that you don’t want to leave your business exposed. You don’t want to build your business up just to have it disappear over a lawsuit. We all have the fear that maybe our business is going to go away one day. Insurance helps to protect you from that.

You can protect yourself with Amazon suspension insurance, as well as cargo insurance, general liability, and product liability to cover your business for any lawsuits that you might experience as an Amazon seller.

What’s your next move?

- If you don’t have an insurance provider, get an insurance provider who is well-versed in Amazon and the eCommerce business structure and knows what types of liabilities and risks your particular business has. If you’re working with someone who doesn’t understand your risks and liabilities, they won’t know how to put you in a position to protect those risks and liabilities. One of the agents trusted in this industry is Ashlyn Hadden Insurance. Ashlyn is well trusted in the space and very knowledgeable and has made it her primary focus to help Amazon sellers. Reach out to her or someone else who is in the industry and knows the Amazon insurance space very well, and get them to audit your business.

- If you don’t understand enough about your insurance, book an appointment with your agent and have them go over your business with you, thoroughly discussing your liabilities and risks, what your exposure is, and how much you’re covered. Find out if you:

- Are covered too much

- Have overlapping coverage and can cut some coverage out

- Are covered for what you need to be covered for

- Have gaps or need product insurance

- Need suspension insurance

Get the answers to these questions, fill in those gaps and make sure that you’re covered and that your business is protected so that you aren’t devastated by the catastrophe of a lawsuit or suspension. You want to make sure that you have peace of mind and a plan to cover yourself as much as possible.

3. Finally, check out SoStocked.com. SoStocked will help you to properly plan your inventory so that you stay in stock despite crises like the Suez canal or a hurricane off China’s coast. Our Amazon inventory management software will help you calm the inventory chaos and prevent you from stockouts that come from unforeseen circumstances so that your business keeps moving forward and keeps the cash flowing!

Need more information?

- Send Message: We typically reply within 2 hours during office hours.

- Schedule Demo: Dive deeper into the nuances of our software with Chelsea.

- Join Live Upcoming Webinar: New to Amazon inventory management? Learn three inventory techniques you can implement right away.

Start Your Free Audit

Start Your Free Audit